CBSE Class 12 Accountancy Important MCQs 2026, Chapter-wise, will help you thoroughly understand each topic of the Accountancy syllabus. The most repeated MCQs increase speed, confidence, and mental clarity for board and competitive exams. Practicing these Accountancy MCQs with Answers 2026 allows students to cover each chapter evenly, ensuring a balanced preparation for board examinations and competitive tests. Download the Accountancy Chapter Wise Weightage 2026 PDFs with solved questios for regular practice.

CBSE Class 12 Accountancy Important MCQs 2026

CBSE Class 12 Accountancy Important MCQs 2026 provides ypu professional explanations to understand each chapter and do well in your Class 12 Accounting examinations. Chapter-wise MCQs for Accountancy Class 12 are collections of multiple-choice questions from Accountancy PYQs Class 12, organized by chapter from the most recent CBSE syllabus.

Important Topics of Accountancy with Chapter-Wise Weightage

Go over the important topics in each chapter of the Accountancy Syllabus mentioned in the table below.

| Accountancy Chapter Wise Weightage 2026 | ||

| Chapter Name | Average Weightage | Primary Focus of Questions / Most Asked Topics |

| Partnership Fundamentals | 8–10 Marks | P&L Appropriation Account, calculation of Interest on Capital/Drawings, Guarantee of Profit (including loss scenarios), and Past Adjustments. |

| Admission of a Partner | 10–14 Marks | New PSR, Sacrificing Ratio, treatment of Goodwill (specifically Hidden Goodwill), Revaluation Account, and Capital Adjustments. |

| Retirement & Death of a Partner | 8–10 Marks | Gaining Ratio, treatment of Goodwill, preparation of Retiring Partner’s Loan Account or Deceased Partner’s Executor Account with interest. |

| Dissolution of a Partnership Firm | 6–8 Marks | Preparation of Realisation Account, treatment of unrecorded assets/liabilities, and settlement of partners’ accounts. |

| Accounting for Share Capital | 8–10 Marks | Pro-rata allotment, Forfeiture and Reissue of shares, and Disclosure of Share Capital in the Balance Sheet as per Schedule III. |

| Accounting for Debentures | 10–12 Marks | Issue of debentures for consideration other than cash, Issue from the point of view of Redemption, Collateral Security, and writing off Discount/Loss. |

| Analysis of Financial Statements | 4–6 Marks | Classification of items under Major Heads and Sub-heads of the Balance Sheet and preparation of Comparative/Common-size statements. |

| Accounting Ratios | 4–6 Marks | Calculation and interpretation of effects of transactions on Liquidity (Current/Quick), Solvency (Debt-Equity), and Activity (Turnover) ratios. |

| Cash Flow Statement | 6–8 Marks | Classification of activities (Operating, Investing, Financing), treatment of Proposed Dividend, and preparation using the Indirect Method. |

Top 15 Most Repeated MCQs from Accountancy Previous Year Papers

- Assertion (A): Each partner carrying on the business of the firm is the principal as well as the agent for all the other partners of the firm.

Reason (R): There exists a relationship of mutual agency between all the partners.

Choose the correct option:

(A) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are correct, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is correct, but Reason (R) is incorrect.

(D) Assertion (A) is incorrect, but Reason (R) is correct.

- Sara and Tara were partners in a firm. Their capitals as on 1st April, 2023 were ₹ 6,00,000 and ₹ 4,00,000 respectively. On 1st October, 2023, Tara withdrew ₹ 1,00,000 for personal use. According to the partnership deed, interest on capital was allowed @ 8% p.a. The amount of interest allowed on Tara’s capital for the year ended 31st March, 2024 was:

(A) ₹ 28,000

(B) ₹ 30,000

(C) ₹ 48,000

(D) ₹ 32,000

- VL Ltd. offered for public subscription 90,000 equity shares of ₹ 10 each at a premium of 10%. The entire amount was payable on application. Applications were received for 1,00,000 shares and allotment was made to all the applicants on pro-rata basis. The amount received on application was:

(A) ₹ 10,00,000

(B) ₹ 9,00,000

(C) ₹ 9,90,000

(D) ₹ 11,00,000

- Money received in advance from the shareholders before it is actually called up by the directors is:

(A) credited to calls in advance account.

(B) debited to calls in advance account.

(C) credited to calls account.

(D) debited to calls in arrears account.

- Moksh and Pran were partners in a firm sharing profits and losses in the ratio of 1 : 2. Their capitals were ₹ 5,00,000 and ₹ 3,00,000 respectively. They admitted Tushar as a new partner on 1st April, 2024 for 1/4th share in future profits. Tushar brought ₹ 4,00,000 as his share of capital. The goodwill of the firm on Tushar’s admission will be:

(A) ₹ 16,00,000

(B) ₹ 4,00,000

(C) ₹ 8,00,000

(D) ₹ 12,00,000

- Anuj and Kartik were partners in a firm sharing profits and losses in the ratio of 5 : 4. Anuj withdrew ₹ 20,000 in the beginning of every alternate month starting from 1st April, 2023 during the year ended 31st March, 2024. Interest on Anuj’s drawings @ 6% p.a. for the year ended 31st March, 2024 will be:

(A) ₹ 8,400

(B) ₹ 1,200

(C) ₹ 4,200

(D) ₹ 3,600

- That portion of the called up capital which has been actually received from the shareholders is known as:

(A) Paid up capital

(B) Called up capital

(C) Uncalled capital

(D) Reserve capital

- Minimum subscription for allotment of shares as per Securities and Exchange Board of India (SEBI) guidelines cannot be less than 90% of __________ capital.

(A) Reserve

(B) Issued

(C) Nominal/Registered

(D) Subscribed

- The Quick Ratio of a company is 2 : 1. Which of the following transactions will result in a decrease in this ratio?

(A) Payment of outstanding salary

(B) Cash received from debtors

(C) Sale of goods at a profit

(D) Purchase of goods for cash

- Cash Flow Statement is prepared in accordance with:

(A) Accounting Standard 3

(B) Accounting Standard 26

(C) The Companies Act, 2013

(D) The Companies Act, 1956

- Assertion (A): The maximum number of partners in a partnership firm is 50.

Reason (R): By virtue of the Companies Act 2013, the Central Government is empowered to prescribe maximum number of partners in a firm. The Central Government has prescribed the maximum number of partners in a firm to be 50.

Choose the correct option:

(A) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is true, but Reason (R) is false.

(D) Both Assertion (A) and Reason (R) are false.

- Ajay Ltd. forfeited 100 shares of ₹ 10 each for non-payment of the first call of ₹ 1 per share and the second and final call of ₹ 3 per share. The minimum price per share at which these shares can be reissued will be:

(A) ₹ 6

(B) ₹ 4

(C) ₹ 10

(D) ₹ 16

- Pooja and Kumari were partners in a firm sharing profits and losses in the ratio of 2 : 1. On 1st April, 2023, Noori was admitted as a new partner for 1/4th share in the profits of the firm. Noori was guaranteed a minimum profit of ₹ 1,20,000. Any deficiency on this account was to be borne by Pooja and Kumari in their profit-sharing ratio. During the year ended 31st March, 2024, the firm earned a net profit of ₹ 3,60,000. The amount of deficiency borne by Pooja will be:

(A) ₹ 20,000

(B) ₹ 1,20,000

(C) ₹ 10,000

(D) ₹ 1,60,000

- Raman Ltd. forfeited 500 shares of ₹ 10 each for non-payment of the final call of ₹ 2 per share. Out of the forfeited shares, 300 shares were reissued at ₹ 12 per share ,fully paid up. The amount that was transferred to the Capital Reserve Account was:

(A) ₹ 2,400

(B) ₹ 3,000

(C) ₹ 4,000

(D) ₹ 5,000

- Assertion (A): Securities Premium cannot be utilized for writing off losses on the sale of a fixed asset.

Reason (R): Securities Premium can be applied only for the purposes mentioned in the Companies Act, 2013.

Choose the correct option:

(A) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct reason of Assertion (A).

(C) Both Assertion (A) and Reason (R) are false.

(D) Assertion (A) is false, but Reason (R) is true.

Download Accountancy MCQs with Answers 2026 PDF

Try the Accountancy MCQs for each chapter without glancing at the answers from the PDF. After you’ve finished, review your responses and read the explanations provided. This technique helps you find holes in your knowledge and boosts your confidence for the main exam.

| Subject | PDF Download Link |

| Accountancy | CBSE Class 12 Accountancy Board Exam Important Questions PDF |

Tips to Crack the Accountancy Board Exam with 95+ Score

Follow the below tips to score more than 95 marks in your acoounts paper.

- Begin with NCERT Revision – All CBSE questions are based on NCERT topics.

- Solve all examples and pictures from textbooks – Many exam questions are directly based on textbook examples.

- Practice MCQs – Chapter-wise MCQs for Accountancy Class 12 cover the entire CBSE syllabus. Structured MCQs improve speed, accuracy, and knowledge of basic accounting principles, making them useful in exams and real-life circumstances.

- Improve your presentation and answer-writing skills – Most students have correct answers, yet they lose marks due to poor presentation. CBSE examiners review hundreds of answer sheets; your goal is to make your answers clean, clear, and examiner-friendly.

- Time Management Strategy for the 3-Hour Exam – Many students leave questions unfinished because they become stuck or spend too much time on one subject.

Ideal Time Distribution for Accountancy Paper CBSE Board Exam 2026

- Reading Time: 10 minutes.

- Short Questions (1-3 Markers): 25-30 min

- Medium Questions (4-6 markers) Duration: 40-50 minutes

- Long Questions (8-12 Markers): 60-70 min

- Revision should lasts: 15-20 minutes.

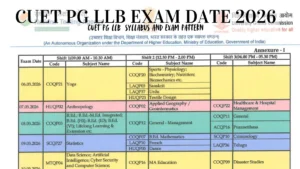

CUET PG LLB Exam Date 2026 OUT, Download...

CUET PG LLB Exam Date 2026 OUT, Download...

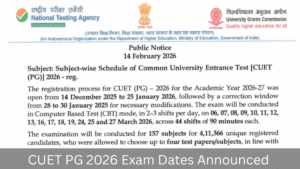

CUET PG 2026 Exam Dates (Out), Check Shi...

CUET PG 2026 Exam Dates (Out), Check Shi...

CBSE 12th Political Science Important MC...

CBSE 12th Political Science Important MC...